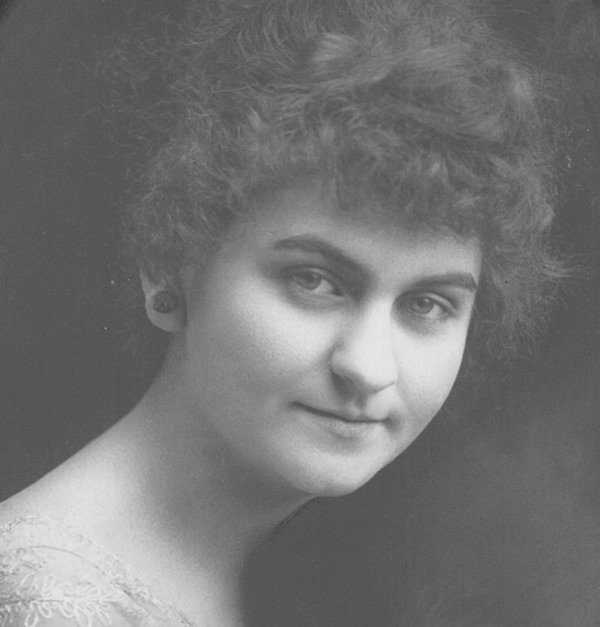

Both George A. Frampton and Cecile Meyer Frampton were born in Nebraska and both to families whose primary vocation was farming. George’s family moved to Oklahoma when he was six to participate in the last land rush in Comanche County to prove up on 160 acres of land. This land stayed in the family through his sister Ida who married Art Runyan. They became successful farmers adding many more quarter sections to the original homestead.

George was the “runt of the litter” leaving the hard work of breaking horses, tending the livestock and harvesting crops to his brother John. George decided to go back to Lincoln, Nebraska to attend the Lincoln School of Commerce from which he completed his course of study while living with his Uncle William Chariton Frampton, a Lincoln attorney. His first job in banking was with a small bank in Denton, Nebraska. With his first paycheck, he bought a shotgun. His transportation to Lincoln was by train. Later he joined a bank in what was then a separate town of Bethany. There he met Cecile Meyer who had attended Cotner College and also the Home Economics Department of the University of Nebraska. To get to class, she rode the interurban street car.

Following their marriage in 1918, Cecile and George moved to Lawton, Oklahoma where George worked in a bank. With help from Nelson Meyer and G.H. Frampton signing the note, they bought a small bank in Faxson, Oklahoma. Cecile taught piano and also worked in the bank until their first child, George Frampton, Jr. was born. He thrived until he was nine months old and was suddenly taken ill from what is now called Sudden Infant Death syndrome and died in just over two days time. He had been born at home as was his brother, Robert E. Frampton, about three years later. By this time George and Cecil had sold the Faxon bank with its sad memories and purchased a bank in Binger, Oklahoma. Hard times and hard work resulted in their having an opportunity to return to Lincoln where George worked at a bank in Havelock, then a separate community. On October l, 1930, Havelock became part of Lincoln and their family grew with the birth of their daughter, Alice Marilyn Frampton, on that same date.

In the 1930s George joined the Lincoln Joint Stock and Land Bank owned by the Barkley Family. Times were tough in the ’30s and farmers often had to make the difficult choice of giving up their mortgaged land or keeping their cattle with which they could grow their way out of debt, if it ever rained so pastures could flourish. Since George had experience with small banks, he had the opportunity to work nights and weekends to merge two banks which were in trouble, to form what is now Union Bank in College View. In these times there was legislation that required bankers to have double liability for the amount of bank stock owned if their bank failed.

Alice Frampton completed her undergraduate degree in business at the University of Nebraska and attended the Harvard-Radcliffe Program in Business Administration in the fall of 1952. Harvard, at that time, did not admit women to their business school but it was a great learning experience which was followed by the opportunity to start work at the bank in Davey. Alice learned from the ground up while completing a Master’s Degree in Finance and Management.

In 1955, Alice married Marcus W. Dittman and they both thrived in banking. The hope was that the bank in Davey could be moved to Lincoln but that did not happen. In 1959, Mark had the opportunity to start a de novo charter bank called Central Bank in Central City, Nebraska. Mark served as president and Alice as cashier. Again, it was a successful venture although very small by today’s standards. Two of their three children, Dawn Lea Dittman and John Frampton Dittman, were born in Central City. The Dittmans found it a joy to be in a town of twenty-five hundred with only one other bank to compete against. Two other opportunities would present themselves, one the chance to move the Farmers State Bank of Davey to Lincoln and change its name to Cornhusker Bank, and the other, a new charter opportunity in Richmond, Missouri, a town of over five thousand. Both of these took place and with Mark’s passing in 1975, Alice became president of the then $8,000,000 bank in Lincoln. After serving twenty-two years as president she turned the position over to her son, John.

In 2014, the Bank had $410,000,000 in total assets and served about twenty thousand customers. Slow and steady growth enabled the bank to serve its customers well and make it through some difficult times in the 1980s and the recession of 2008.

Personal integrity and concern over the welfare of the bank’s customers is a legacy passed down from George and Cecile Frampton. Their children, Bob and Alice, appreciate the hard work and sacrifice that made Cornhusker Bank possible from very small beginnings.

The farming heritage also continues with Alice”˜s son Douglas Scott Dittman who farms in Lancaster County.

The one hundred and twenty-five employees of Cornhusker Bank also typify the desire to give good service to the bank’s customers who entrust their funds to it. This trust has to be earned over and over again without fail. Integrity is the key to lasting success. Examples of hard work and integrity are shining examples of true success.

The family pleased to have a small part in this great tribute of the mall connecting the Capitol to the University campus.

Information provided by Alice Frampton Dittman in June, 2014.